The construction industry is unique, requiring specialized tools to manage its complex financial, operational, and project-specific demands. For contractors and construction firms, GAAP Construction Accounting Software provides a robust solution by integrating accounting principles with industry-specific functionalities. This software ensures financial processes adhere to Generally Accepted Accounting Principles (GAAP) while addressing the nuances of project-based accounting, revenue recognition, and cost management.

This guide explores the features, benefits, and leading examples of GAAP construction accounting software to help you understand its importance and functionality in the construction sector.

Table of Contents

- Introduction

- Key Features of GAAP Construction Accounting Software

- Benefits of Using GAAP Construction Accounting Software

- Examples of Popular GAAP Construction Accounting Software

- Conclusion

Key Features of GAAP Construction Accounting Software

1. Compliance with GAAP Standards

GAAP ensures financial statements are consistent, accurate, and transparent. Software designed with GAAP compliance enables construction firms to meet regulatory requirements, reducing the risk of audits and penalties.

2. Job Costing

One of the most critical features, job costing, tracks all costs associated with a project, including labor, materials, and equipment. It enables firms to determine profitability at a granular level and control expenses.

3. Progress Billing

This feature allows contractors to generate invoices based on project progress, rather than fixed timelines. It supports milestone-based billing, which aligns with industry practices and helps manage cash flow efficiently.

4. Revenue Recognition

Construction projects often span multiple accounting periods, requiring accurate revenue recognition. Software facilitates methods like:

- Percentage-of-Completion Method: Recognizes revenue based on work completed.

- Completed-Contract Method: Recognizes revenue only after the entire project is completed.

5. Retainage Tracking

Retainage—the portion of payment withheld until a project is complete—is a standard practice in construction. This feature tracks withheld amounts and ensures accurate financial reporting.

6. Payroll Management

Construction payroll is often complex, involving union wages, prevailing wage laws, and multi-state taxes. Specialized software automates payroll processes while ensuring compliance with these requirements.

7. Change Order Management

In construction, changes in project scope are common. Change order management tracks and updates budgets, contracts, and forecasts to reflect these adjustments.

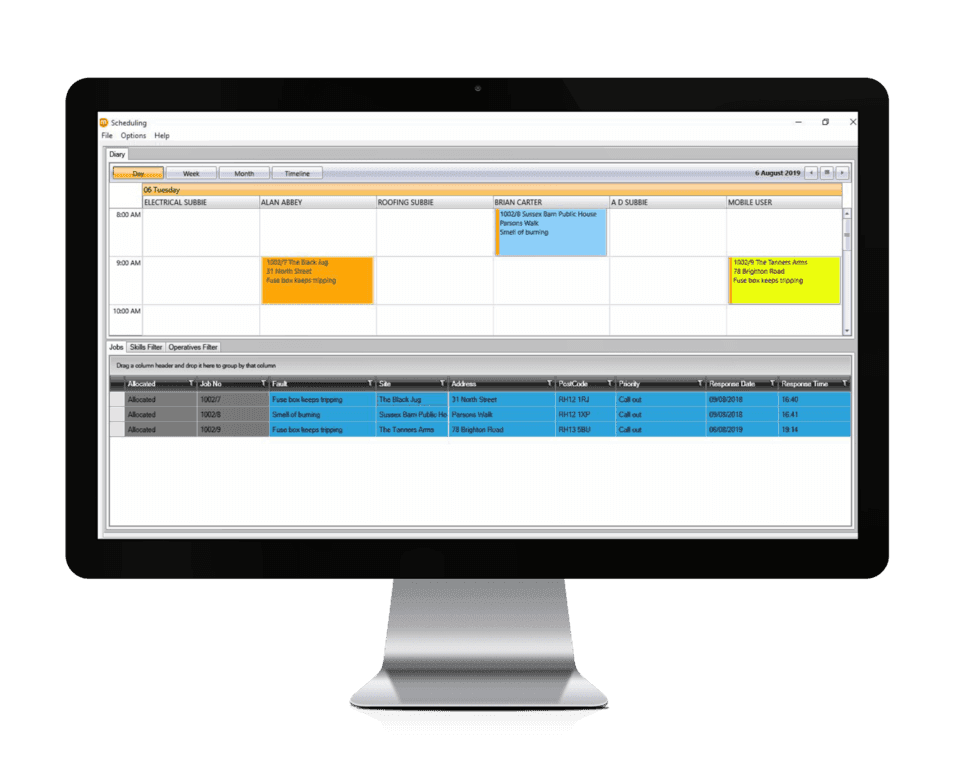

8. Project Management Integration

Integrating project management with accounting tools allows for real-time data sharing between teams, improving collaboration and decision-making.

9. Multi-Entity and Multi-Location Support

Large contractors often operate across regions or under multiple business entities. The software can handle the complexities of consolidated financial reporting, tax compliance, and inter-entity transactions.

10. Custom Reporting

Construction accounting tools generate detailed, customizable financial reports, offering insights into project profitability, cash flow, and overall financial health.

Benefits of Using GAAP Construction Accounting Software

1. Accurate Financial Reporting

GAAP compliance ensures all financial statements are prepared to meet regulatory standards, reducing errors and enhancing transparency.

2. Improved Decision-Making

Access to real-time financial and operational data enables stakeholders to make informed decisions, ensuring projects stay within budget and deadlines are met.

3. Streamlined Operations

By automating processes like billing, payroll, and job costing, the software reduces administrative workload, increases efficiency, and minimizes errors.

4. Cost and Time Savings

Automating complex financial tasks saves time and reduces manual errors, lowering overall administrative costs.

5. Scalability

As construction businesses grow, their operational complexities increase. GAAP construction accounting software can scale to handle more projects, higher budgets, and expanded teams.

Examples of Popular GAAP Construction Accounting Software

1. Sage 300 Construction and Real Estate

- A leading solution for medium to large firms.

- Features include job costing, project management, and advanced financial reporting.

2. Procore

- Combines construction project management with accounting.

- Integrates with other financial tools for seamless data sharing.

3. QuickBooks Desktop for Contractors

- Ideal for small and mid-sized firms.

- Provides job costing, invoicing, and GAAP-compliant reporting.

4. FOUNDATION Software

- Specifically built for construction companies.

- Offers robust payroll, job costing, and project tracking features.

5. Viewpoint Vista

- Designed for large contractors with complex needs.

- Includes multi-entity support and advanced revenue recognition capabilities.

Conclusion

GAAP Construction Accounting Software is a game-changer for construction businesses. By combining industry-specific features with financial compliance, it streamlines operations, enhances reporting accuracy, and supports growth. Whether you’re a small contractor or a large enterprise, investing in the right software can optimize your financial management and improve your bottom line.

Choosing a solution tailored to your firm’s size and operational complexity ensures you get the most value from these powerful tools.